Sales shipped to the UK (eBay VAT Responsible) are those where: Sales shipped to the UK (Seller VAT Responsible) are those where:

Select Payout report from the dropdown menu.From the menu on the left, select Reports.

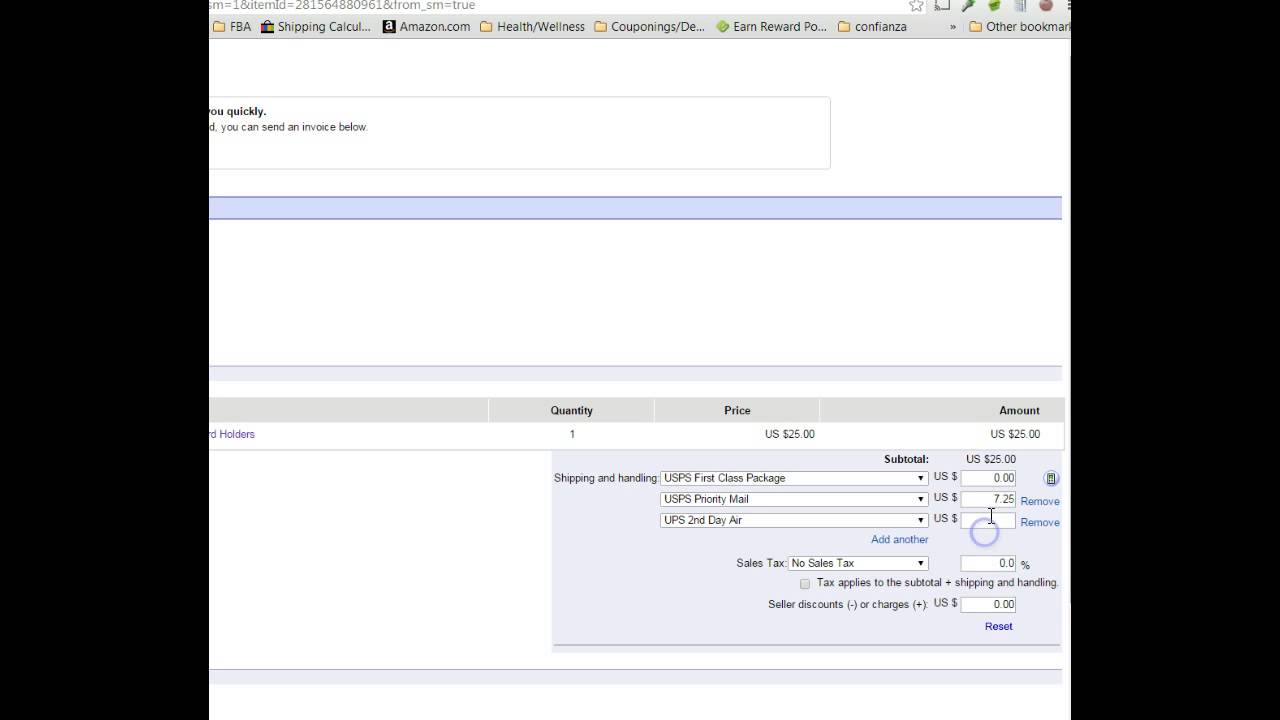

EBAY MONTHLY INVOICE HOW TO

Here’s how to download your Payout report: Your Payout report provides a summary of your payouts for a specific date range. We can discuss this more later.ĮBay recently made some upgrades to their Managed Payments Payout report, so the sales, refunds, and eBay fees we need are all in there now. For example, a sale going to a UK customer would typically incur 20% VAT, but a sales going to a customer outside the UK is classed as an export and, as such, is typically zero rated for UK VAT.ĭepending on where your business is established, you may also need to consider sales where eBay is responsible for collecting and remitting the VAT directly to HMRC too. The sales and refunds figures need to be split by destination country because they may need to be treated differently for VAT. What figures do you need for accurate eBay bookkeeping?įirstly, taking a step back, let's have a think about what figures from your eBay reports you actually need for accurate bookkeeping of your eBay sales.

0 kommentar(er)

0 kommentar(er)